An Asset That Is Impaired Is Best Described as

The systematic allocation of a n assets cost less residual value over the useful life. The impairment of a fixed asset can be described as an abrupt decrease in fair value Fair Value Fair value refers to the actual value of an asset - a product stock or security - that is agreed upon by both the seller and the buyer.

Impaired Asset Overview Why It Should Be Reported Calculation

The systematic allocation of cost of an asset less residual value over the useful life d.

. Which of the following best describes recoverable amount. In profit or loss. The removal of an asset from the statement of financial position b.

As a result reporting is based on current events that affect the business. According to IAS36 Impairment of assets how should each of the impairment losses be recognised. Assets are considered impaired when the book value or net carrying value exceeds expected future cash flows.

It is a hedge of the exposure to changes in fair value of a recognized asset or liability or an unrecognized firm commitment or an identified portion of such an asset liability or firm commitment that is attributable to a particular risk and could affect surplus or deficit. The forecasted undiscounted cash flow identified with the asset is less than the carrying value book value of the asset. The higher of fair value less disposal costs and the.

In profit or loss 4. IAS 36 Impairment of Assets seeks to ensure that an entitys assets are not carried at more than their recoverable amount ie. In profit or loss.

Asset impairment is a financial term. The amount by which the recoverable amount of an asset exceeds the carrying. Businesses recognize impairment when the financial statement carrying amount of a long-lived asset or asset group exceeds its fair value and is not recoverable.

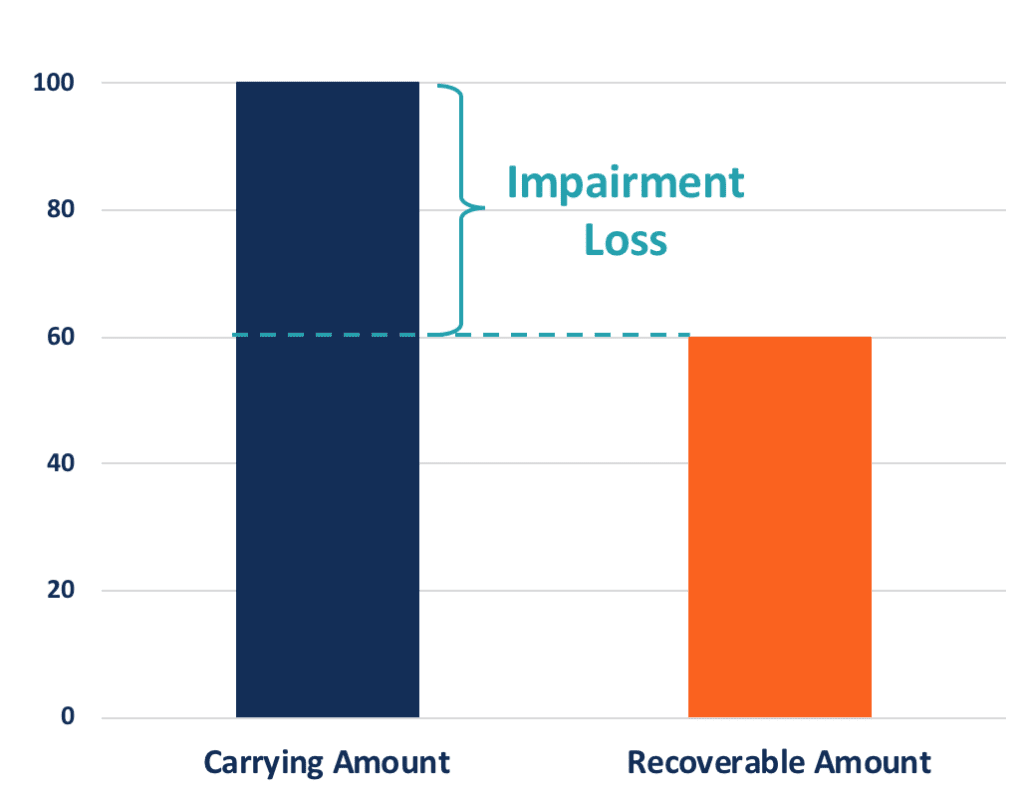

In other comprehensive income 3. If the carrying amount exceeds the recoverable amount the asset is described as impaired. The entity must reduce the carrying amount of the asset to its recoverable amount and.

When the projected worth of the asset is less than its current worth the asset is considered to be impaired. Judging whether or not an asset is impaired. The Standard also specifies when an entity should reverse an impairment loss and prescribes disclosures.

The amount by which the carrying amount of an asset exceeds the recoverable amount. Under PAS 36 Impairment of assets which of the. In profit or loss 2.

The plethora of corporate restructuring that took place during the. Fair value is applicable to a product that is sold or traded in the market where it belongs or under normal conditions - and not to one that. The amount by which the carrying amount of an asset exceeds the recoverable amount c.

IAS 36 Impairment of Assets requires that an asset is not carried at more than its recoverable amount. Which of the following statements best describes the term impairment loss. In other comprehensive income.

The entity must reduce the carrying amount of the asset to its recoverable amount and recognise an impairment loss. Which statement best describes impairment loss. A good impairment test promotes transparency because the trigger is a change in underlying economic or business condition s not an arbitrary period.

Definition of Impairment 5. A carrying amount is not recoverable if it is greater than the sum of the undiscounted cash flows expected from the assets use and eventual disposal. Governments generally hold capital assets because of the services the capital assets.

Impaired or whether intangible assets have lost value. If there is an indication that an asset may be impaired this may indicate that the remaining useful life the depreciation amortisation method or the residual value for the asset need to be reviewed and adjusted under the Accounting Standard applicable to the asset such as Accounting Standard AS 6 Depreciation Accounting even if no impairment loss is recognised. The net amount which an entity expects to obtain for an asset at the end of its useful life d.

In other comprehensive income. The forecasted undiscounted cash flow identified with the asset is greater than the carrying value book value of the asset. The higher of the present value of all future cash flows associated with the asset for the rest of its useful life and fair value.

Typically management is given the power to judge when or if an impairment exists. In other comprehensive income. With the exception of goodwill and certain intangible assets for which an annual impairment test is required entities are required to conduct impairment tests where there is an indication of.

Any permanently andor temporarily impaired capital assets that are idle as of year-end must be disclosed. What statement best describes if a long-lived asset fixed asset is impaired. ³Intangible assets with an identifiable remaining.

The impaired capital asset must individually have a carrying value equal to or greater than 10 million. The higher of fair value less costs of disposal and value in use. Part 2 Idle Capital Assets Temporarily Impaired identifies capital assets that are temporarily impaired as follows.

The amount at which an asset could be exchanged between knowledgeable willing parties in an arms length transaction 33. The removal of an asset from the statement of financial position. An impaired asset is one whose value has declined below its depreciated or amortized value.

The amount of cash or cash equivalents that could currently be obtained by selling an asset in an orderly disposal c. If this is the case the asset is described as impaired and the Standard requires the entity to recognise an impairment loss. If the carrying amount exceeds the recoverable amount the asset is described as impaired.

If the impairment is permanent is must be reflected in the financial statements. Asset impairment is a significant unexpected decline in the service utility of a capital asset. IAS 36 also applies to groups of assets that do not generate cash flows individually known as cash-generating units.

The core principle in IAS 36 is that an asset must not be carried in the financial statements at more than the highest amount to be recovered through its use or sale. Associated with impairment of capital assets.

Iot In Healthcare 20 Examples That Ll Make You Feel Better Iot Health Care Medical Waste Management

Comments

Post a Comment